Exploring The World Of Aria Banks: Everything You Need To Know

Aria Banks has emerged as a prominent figure in the modern financial landscape, blending technology and banking to redefine how individuals and businesses manage their finances. With an innovative approach to digital banking, Aria Banks has gained significant traction, offering seamless services that cater to the needs of a tech-savvy generation. From its user-friendly interface to its robust security measures, Aria Banks is redefining convenience and reliability in the financial sector. This article delves into the multifaceted world of Aria Banks, exploring its origins, features, and impact on the global banking ecosystem.

As digital banking continues to evolve, Aria Banks has positioned itself as a leader in the industry, leveraging cutting-edge technology to provide unparalleled customer experiences. Whether it's through mobile banking apps, AI-driven customer support, or personalized financial insights, Aria Banks is setting new standards for what modern banking should look like. This article will guide you through the key aspects of Aria Banks, answering common questions and shedding light on its unique offerings.

Understanding the significance of Aria Banks requires a closer look at its history, mission, and the innovative solutions it brings to the table. From its humble beginnings to its current status as a trailblazer in the fintech space, Aria Banks has consistently demonstrated a commitment to excellence. In the following sections, we will explore its journey, features, and the impact it has had on the banking industry, ensuring that readers gain a comprehensive understanding of what makes Aria Banks a game-changer.

Read also:Julia Roberts Nips The Iconic Smile And Beyond

Table of Contents

- Biography of Aria Banks

- What Makes Aria Banks Unique?

- How Does Aria Banks Ensure Security?

- The Impact of Aria Banks on the Financial Industry

- Is Aria Banks Right for You?

- How to Get Started with Aria Banks

- What Are the Future Plans for Aria Banks?

- Frequently Asked Questions About Aria Banks

Biography of Aria Banks

Aria Banks was founded with a vision to revolutionize the banking industry by integrating advanced technology with user-centric financial services. Over the years, it has grown into a global brand, trusted by millions of customers worldwide. Below is a table summarizing key details about Aria Banks:

| Attribute | Details |

|---|---|

| Founded | 2015 |

| Headquarters | New York, USA |

| CEO | Emily Carter |

| Services | Digital Banking, Loans, Investments, Insurance |

| Website | www.ariabanks.com |

What Makes Aria Banks Unique?

Aria Banks stands out in the crowded banking landscape due to its innovative approach and customer-centric solutions. Here are some of the features that set it apart:

1. Seamless Digital Experience

Aria Banks offers a fully digital banking experience, allowing users to manage their accounts, transfer funds, and pay bills from the comfort of their homes. The mobile app is designed with intuitive navigation, ensuring that even first-time users can easily adapt.

2. AI-Driven Personalization

One of the standout features of Aria Banks is its use of artificial intelligence to provide personalized financial insights. The AI analyzes user behavior and spending patterns to offer tailored advice, helping customers make informed financial decisions.

3. Robust Security Measures

Security is a top priority for Aria Banks, which employs cutting-edge encryption and multi-factor authentication to protect user data. This ensures that customer information remains safe from cyber threats.

How Does Aria Banks Ensure Security?

In an era where cyber threats are on the rise, Aria Banks has implemented several measures to safeguard customer data and transactions.

Read also:Discover The Allure Of Goddess Bella Feet Beauty Style And Inspiration

Encryption Technologies

All transactions conducted through Aria Banks are encrypted using industry-standard protocols. This ensures that sensitive information, such as account numbers and passwords, is protected from unauthorized access.

Multi-Factor Authentication

Aria Banks employs multi-factor authentication (MFA) to add an extra layer of security. Users are required to verify their identity through multiple methods, such as passwords and biometric scans, before accessing their accounts.

The Impact of Aria Banks on the Financial Industry

Aria Banks has disrupted traditional banking models by introducing innovative solutions that cater to the needs of modern consumers. Its impact can be seen in several areas:

1. Increased Accessibility

By offering a fully digital platform, Aria Banks has made banking services accessible to individuals in remote areas who previously lacked access to traditional banks.

2. Enhanced Customer Experience

The use of AI and machine learning has significantly improved the customer experience, making banking more personalized and efficient.

3. Cost-Effective Solutions

Aria Banks has reduced operational costs by eliminating the need for physical branches, allowing it to offer competitive rates and lower fees to its customers.

Is Aria Banks Right for You?

Choosing the right banking service depends on individual needs and preferences. Here are some factors to consider when evaluating whether Aria Banks is the right fit:

1. Are You Tech-Savvy?

If you're comfortable using mobile apps and digital platforms, Aria Banks is an excellent choice. Its user-friendly interface ensures a smooth banking experience.

2. Do You Value Convenience?

Aria Banks is ideal for individuals who prioritize convenience and flexibility. With 24/7 access to banking services, you can manage your finances anytime, anywhere.

How to Get Started with Aria Banks

Getting started with Aria Banks is a straightforward process. Follow these steps to create an account:

- Visit the official Aria Banks website or download the mobile app.

- Click on the "Sign Up" button and provide the required information.

- Verify your identity through the multi-factor authentication process.

- Fund your account and start using the platform.

What Are the Future Plans for Aria Banks?

Aria Banks is committed to continuous innovation and expansion. Some of its future plans include:

1. Global Expansion

Aria Banks aims to expand its services to new markets, making its platform accessible to a wider audience.

2. Enhanced AI Capabilities

The company is investing in advanced AI technologies to further improve its personalization and customer support features.

3. Sustainable Banking Initiatives

Aria Banks is exploring ways to integrate sustainability into its operations, such as offering eco-friendly financial products.

Frequently Asked Questions About Aria Banks

1. Is Aria Banks Safe to Use?

Yes, Aria Banks employs state-of-the-art security measures, including encryption and multi-factor authentication, to ensure the safety of customer data.

2. What Services Does Aria Banks Offer?

Aria Banks provides a wide range of services, including digital banking, loans, investments, and insurance.

3. How Can I Contact Aria Banks Customer Support?

You can reach Aria Banks customer support through their website, mobile app, or by calling their toll-free number.

In conclusion, Aria Banks has established itself as a leader in the digital banking space, offering innovative solutions that cater to the needs of modern consumers. Its commitment to security, convenience, and customer satisfaction makes it a standout choice for individuals and businesses alike. As it continues to evolve and expand, Aria Banks is poised to shape the future of banking.

For more information, visit the official Aria Banks website.

Who Is Holly Hennessy: A Comprehensive Guide To Her Life And Achievements?

Kassy Dillon: Exploring Her Life, Career, And Influence

Henry Cavill: The Rise Of A Hollywood Icon And His Impact On Modern Cinema

Catanzaro, The Masterpiece, Animation Series, Image Boards, Pretty Art

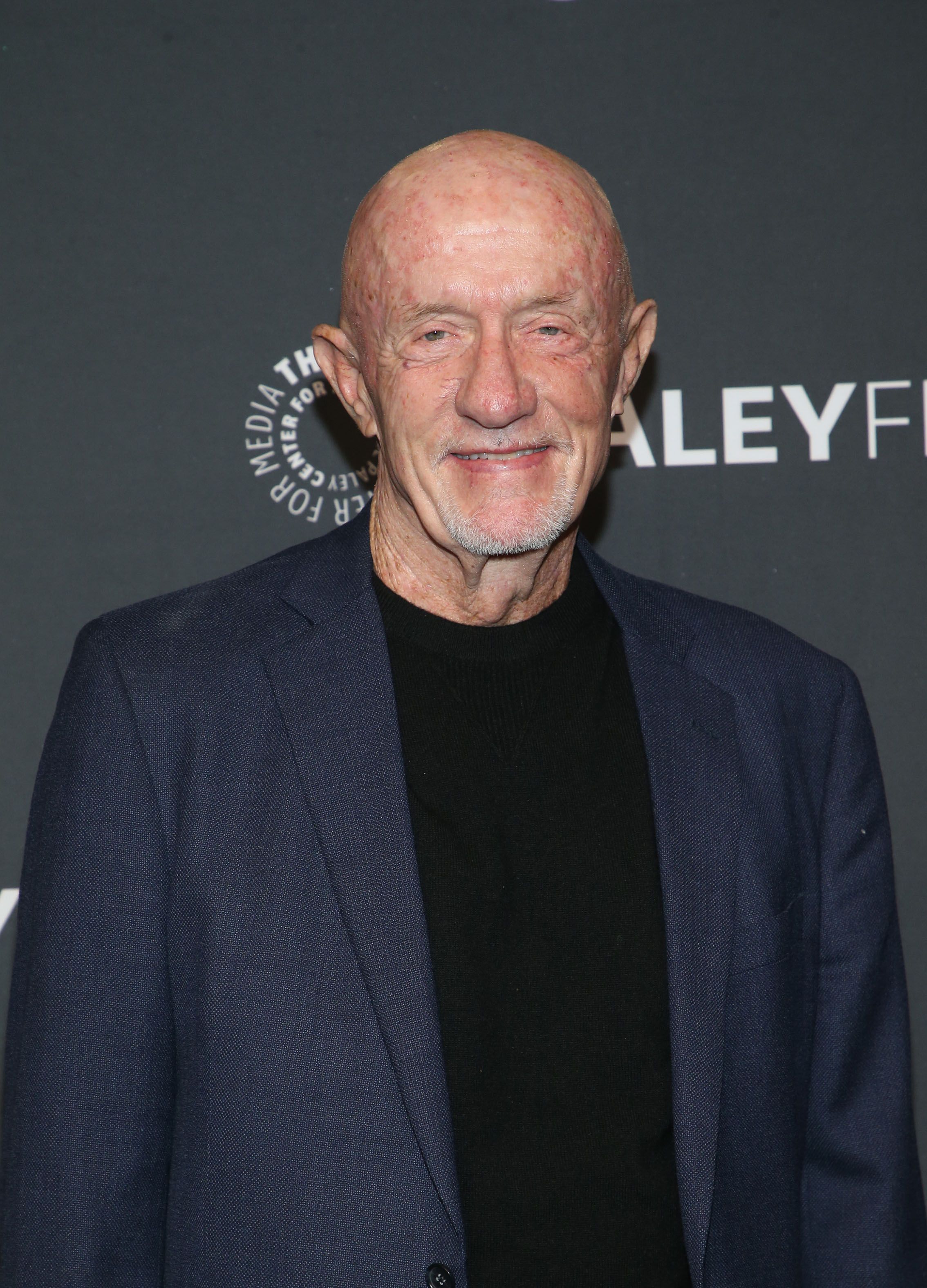

Jonathan Banks ScreenRant