What Is Touch Money V? A Comprehensive Guide To Understanding Its Impact And Benefits

With its cutting-edge technology and user-friendly interface, this innovative platform offers a seamless experience for users looking to streamline their financial transactions. Whether you're a small business owner or someone managing personal finances, Touch Money V provides a robust solution to simplify and enhance financial management. Its ability to integrate advanced features like real-time analytics, secure payment processing, and customizable tools makes it a standout choice for anyone seeking efficiency and reliability. In recent years, the financial technology sector has seen unprecedented growth, with platforms like Touch Money V leading the charge. This platform is designed to cater to the evolving needs of users who demand convenience, security, and flexibility in managing their money. By leveraging the power of cloud-based systems and AI-driven algorithms, Touch Money V ensures that users can access their financial data anytime, anywhere, without compromising on safety. Its intuitive design and accessibility have made it a popular choice among tech-savvy individuals and businesses alike. As we delve deeper into the functionalities and advantages of Touch Money V, it becomes clear why this platform is gaining traction globally. From its ability to automate repetitive tasks to its emphasis on providing actionable insights, Touch Money V is more than just a financial tool—it’s a game-changer. In this article, we will explore how Touch Money V works, its key features, and the benefits it offers to its users. Whether you’re new to the platform or looking to maximize its potential, this guide will provide you with all the information you need to make the most of Touch Money V.

Table of Contents

- What is Touch Money V and How Does It Work?

- What Are the Key Features of Touch Money V?

- What Are the Benefits of Using Touch Money V for Personal Finance?

- How Can Businesses Benefit from Touch Money V?

- How Does Touch Money V Ensure Security and Privacy?

- What Are the Future Innovations of Touch Money V?

- How Does Touch Money V Enhance User Experience?

- Frequently Asked Questions About Touch Money V

What is Touch Money V and How Does It Work?

Touch Money V is a state-of-the-art financial management platform designed to simplify and optimize financial transactions for both individuals and businesses. At its core, the platform operates on a cloud-based infrastructure, allowing users to access their financial data from any device with an internet connection. This accessibility is one of the key reasons why Touch Money V has become a go-to solution for those looking to manage their finances efficiently. The platform uses advanced algorithms to process transactions, track spending patterns, and provide real-time insights into financial health.

One of the standout features of Touch Money V is its seamless integration with various financial institutions and payment gateways. This integration ensures that users can consolidate all their financial accounts in one place, eliminating the need to log into multiple platforms. Whether it’s bank accounts, credit cards, or investment portfolios, Touch Money V provides a unified dashboard where users can monitor their financial activities. The platform also supports automated transactions, enabling users to set up recurring payments, bill reminders, and budget alerts to stay on top of their finances.

Read also:What Is Blue Lock A Comprehensive Guide To The Revolutionary Soccer Training Program

Another critical aspect of how Touch Money V works is its emphasis on customization. Users can tailor the platform to suit their specific needs by setting up personalized categories, creating custom reports, and configuring alerts based on their preferences. For instance, small business owners can use Touch Money V to track expenses, generate invoices, and manage payroll, all within a single interface. Similarly, individuals can use the platform to create savings goals, monitor investments, and even plan for major life events like buying a home or funding education. With its intuitive design and robust functionality, Touch Money V is transforming the way people interact with their finances.

What Are the Key Features of Touch Money V?

Touch Money V is packed with a wide array of features that set it apart from other financial management tools. These features are designed to cater to a diverse range of users, from individuals managing personal budgets to businesses handling complex financial operations. Below, we’ll explore some of the most notable features that make Touch Money V a standout platform.

Real-Time Financial Tracking

One of the most significant advantages of Touch Money V is its ability to provide real-time updates on financial activities. Users can view their account balances, transaction histories, and spending patterns as they happen, ensuring they always have an accurate picture of their financial health. This feature is particularly useful for businesses that need to monitor cash flow and make quick decisions based on up-to-date information.

Automated Budgeting Tools

Touch Money V simplifies the budgeting process by offering automated tools that categorize expenses and income. Users can set budget limits for different spending categories, and the platform will send notifications when they are approaching or exceeding those limits. This helps individuals and businesses stay on track with their financial goals and avoid overspending.

Multi-Currency Support

For users who deal with international transactions, Touch Money V offers multi-currency support. This feature allows users to manage accounts in different currencies, convert funds at competitive exchange rates, and track global financial activities without hassle. It’s an invaluable tool for businesses operating in multiple countries or individuals who frequently travel abroad.

Customizable Reporting

Another key feature of Touch Money V is its customizable reporting capabilities. Users can generate detailed reports on their financial activities, including income, expenses, investments, and more. These reports can be tailored to specific timeframes, categories, or financial goals, providing users with actionable insights to improve their financial strategies.

Read also:Discover The Magic Of Luna Lovely A Comprehensive Guide

Secure Payment Processing

Security is a top priority for Touch Money V, and the platform offers robust payment processing features to ensure safe transactions. With end-to-end encryption and two-factor authentication, users can rest assured that their financial data is protected from unauthorized access. Additionally, the platform complies with international security standards, making it a trusted choice for handling sensitive financial information.

Mobile Accessibility

Touch Money V’s mobile app allows users to manage their finances on the go. The app is available on both iOS and Android devices and offers the same functionality as the desktop version. Whether you’re checking account balances, paying bills, or reviewing financial reports, the mobile app ensures you have full access to your financial data wherever you are.

What Are the Benefits of Using Touch Money V for Personal Finance?

For individuals looking to take control of their personal finances, Touch Money V offers a host of benefits that make financial management easier, more efficient, and more secure. Whether you're saving for a major life goal, tracking daily expenses, or planning for retirement, this platform provides the tools and insights needed to achieve financial stability. Below, we’ll explore the key advantages of using Touch Money V for personal finance.

Simplified Expense Tracking

One of the standout benefits of Touch Money V is its ability to simplify expense tracking. By automatically categorizing transactions and providing real-time updates, the platform eliminates the need for manual record-keeping. Users can easily monitor their spending habits, identify areas where they can cut costs, and adjust their budgets accordingly. This level of transparency helps individuals make informed financial decisions and avoid unnecessary expenses.

Goal-Oriented Savings Plans

Touch Money V allows users to set up personalized savings goals and track their progress over time. Whether it’s saving for a vacation, a down payment on a house, or an emergency fund, the platform provides tools to help users stay motivated and on track. Automated reminders and progress reports ensure that users remain accountable to their financial goals, making it easier to achieve them.

Debt Management Tools

For individuals dealing with debt, Touch Money V offers specialized tools to help manage and reduce liabilities. Users can consolidate all their debt accounts into one dashboard, view repayment schedules, and even simulate different repayment strategies to find the most cost-effective approach. This feature empowers users to take control of their debt and work towards financial freedom.

Investment Tracking and Insights

Touch Money V also caters to individuals who are interested in growing their wealth through investments. The platform allows users to track their investment portfolios, monitor performance, and receive personalized insights based on market trends. This feature is particularly beneficial for those who are new to investing, as it provides a clear understanding of how their investments are performing and where they can make improvements.

Enhanced Financial Security

Security is a top priority for Touch Money V, and this extends to personal finance management as well. The platform uses advanced encryption and multi-factor authentication to protect users’ financial data from unauthorized access. Additionally, users can set up alerts for suspicious activities, ensuring that they are always aware of any potential threats to their accounts.

Time-Saving Automation

By automating repetitive tasks such as bill payments, budget updates, and expense categorization, Touch Money V saves users valuable time. This automation allows individuals to focus on more important aspects of their financial planning, such as setting long-term goals or exploring new investment opportunities. The platform’s ability to handle these tasks efficiently makes it an indispensable tool for anyone looking to streamline their personal finances.

How Can Businesses Benefit from Touch Money V?

Touch Money V is not just a tool for personal finance management; it also offers a wide range of features that are specifically designed to meet the needs of businesses. From small startups to large enterprises, this platform provides solutions that streamline financial operations, enhance decision-making, and improve overall efficiency. Below, we’ll explore how businesses can leverage Touch Money V to achieve their financial goals and drive growth.

Streamlined Accounting and Bookkeeping

For businesses, maintaining accurate financial records is crucial for compliance and decision-making. Touch Money V simplifies this process by offering automated accounting and bookkeeping tools. The platform can integrate with existing accounting software, import transaction data, and categorize expenses automatically. This reduces the time and effort required for manual data entry and minimizes the risk of errors. Additionally, businesses can generate financial statements, tax reports, and audit trails with just a few clicks, ensuring they are always prepared for regulatory requirements.

Efficient Payroll Management

Managing payroll can be a complex and time-consuming task for businesses of all sizes. Touch Money V addresses this challenge by providing a comprehensive payroll management system. The platform allows businesses to process employee salaries, calculate taxes, and generate payslips seamlessly. It also supports direct deposits, ensuring employees receive their payments on time. By automating payroll tasks, businesses can reduce administrative overhead and focus on core operations.

Real-Time Cash Flow Monitoring

Cash flow management is a critical aspect of running a successful business. Touch Money V enables businesses to monitor their cash flow in real-time, providing insights into income, expenses, and outstanding payments. This feature helps businesses identify potential cash flow issues before they become problematic and make informed decisions to maintain financial stability. For example, businesses can use the platform to track accounts receivable and payable, ensuring timely payments and collections.

Customizable Financial Reporting

Touch Money V’s customizable reporting tools are invaluable for businesses that need to analyze their financial performance. The platform allows businesses to create detailed reports on various aspects of their operations, such as revenue, expenses, profitability, and more. These reports can be tailored to specific timeframes, departments, or projects, providing actionable insights that drive strategic decision-making. Additionally, the platform supports exporting reports in multiple formats, making it easy to share data with stakeholders or regulatory bodies.

Expense Management and Control

Controlling business expenses is essential for maintaining profitability. Touch Money V offers robust expense management features that help businesses track and control their spending. The platform allows businesses to set budget limits for different departments or projects and provides alerts when these limits are exceeded. This ensures that businesses stay within their financial constraints and avoid unnecessary expenses. Additionally, the platform supports receipt uploads and expense approvals, streamlining the reimbursement process for employees.

Scalability for Growing Businesses

As businesses grow, their financial needs become more complex. Touch Money V is designed to scale with businesses, offering features that adapt to changing requirements. Whether it’s adding new users, integrating additional financial accounts, or expanding to new markets, the platform can accommodate the evolving needs of growing businesses. This scalability ensures that businesses can continue to rely on Touch Money V as a trusted financial management solution, regardless of their size or complexity.

How Does Touch Money V Ensure Security and Privacy?

In today’s digital age, security and privacy are paramount when it comes to managing financial data. Touch Money V takes these concerns seriously, employing a multi-layered approach to protect user information and ensure the platform remains a trusted solution for financial management. Below, we’ll explore the various security measures and privacy protocols that make Touch Money V a secure choice for both individuals and businesses.

End-to-End Encryption

One of the foundational security features of Touch Money V is its use of end-to-end encryption. This technology ensures that all data transmitted between users and the platform is encrypted, making it unread

Stepmom Shared Bed: Understanding Family Dynamics And Emotional Connections

Unveiling The Journey Of TS Brittney Kade: A Rising Star

Discovering Denise Nicole Frazier: A Comprehensive Guide To Her Life And Achievements

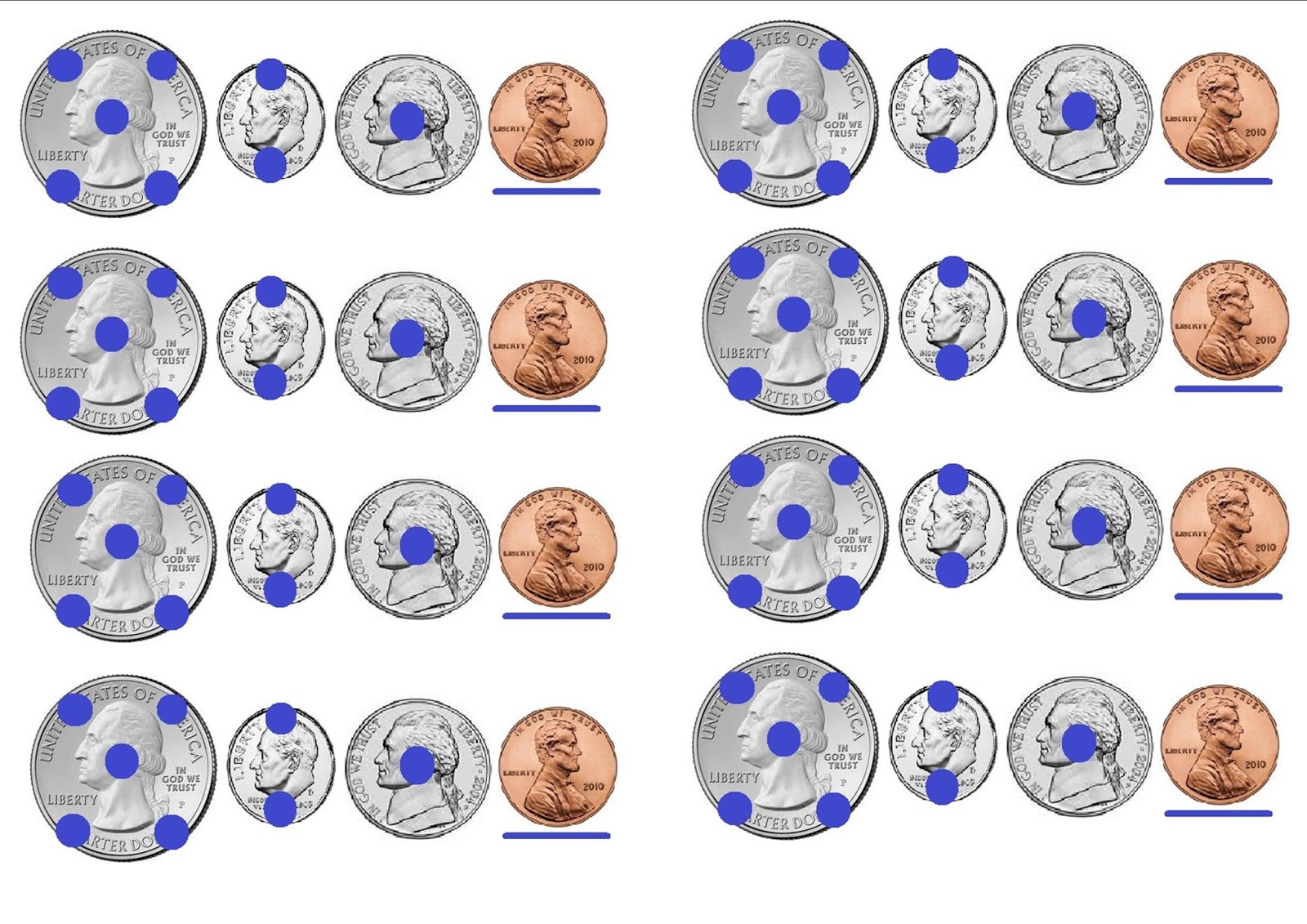

Touch Money Worksheets

DUMMY SHMONEY!!!! r/Tewtiy