Akbank Dava Açma: A Complete Guide To Legal Processes And Procedures

Akbank dava açma is a critical process that requires careful planning and understanding of the legal framework in Turkey. Whether you are an individual seeking justice or a business aiming to resolve disputes, knowing how to initiate legal action against Akbank or any other financial institution is essential. This process involves multiple steps, including gathering evidence, understanding legal rights, and preparing documentation. With the increasing complexity of banking operations, it is crucial to stay informed about your rights and the resources available to you. This guide will walk you through everything you need to know about Akbank dava açma, ensuring you are well-prepared to take the necessary steps.

Many individuals and businesses face challenges when dealing with banks, such as unresolved complaints, unfair practices, or financial discrepancies. In such cases, legal recourse becomes inevitable. Akbank, one of Turkey's leading financial institutions, has a well-established legal framework for handling disputes. However, navigating this framework can be daunting without proper guidance. Understanding the steps involved in Akbank dava açma can help you protect your interests and ensure a fair resolution. This article aims to demystify the process, offering detailed insights and actionable advice to empower you.

As we delve deeper into the topic, we will explore the legal procedures, customer rights, and frequently asked questions about Akbank dava açma. Whether you are filing a lawsuit for the first time or seeking to enhance your understanding of the process, this guide is designed to provide clarity and confidence. By the end of this article, you will have a comprehensive understanding of how to approach Akbank dava açma effectively and efficiently.

Read also:Endgame Ww3 Unraveling The Possibilities And Implications

Table of Contents

- What is Akbank Dava Açma?

- Why Should You Consider Filing a Lawsuit Against Akbank?

- Step-by-Step Guide to Initiating Akbank Dava Açma

- What Are Your Rights as an Akbank Customer?

- Common Reasons for Filing a Lawsuit Against Akbank

- How Long Does the Akbank Dava Açma Process Take?

- Frequently Asked Questions About Akbank Dava Açma

- Conclusion

What is Akbank Dava Açma?

Akbank dava açma refers to the legal process of filing a lawsuit against Akbank, one of Turkey's largest financial institutions. This process is typically initiated when customers encounter issues such as unresolved complaints, unfair banking practices, or financial discrepancies. The term "dava açma" translates to "filing a lawsuit" in Turkish, and it encompasses a range of legal actions that individuals or businesses can take to seek justice or compensation. Understanding this process is crucial for anyone who feels their rights as a customer have been violated.

The legal framework for Akbank dava açma is governed by Turkish banking and consumer protection laws. These laws ensure that customers have the right to seek redress through legal channels if they believe they have been treated unfairly. For instance, if a customer discovers unauthorized transactions in their account or faces difficulties in resolving a complaint through Akbank's customer service, they may choose to escalate the matter by filing a lawsuit. This process involves submitting a formal complaint to the court and presenting evidence to support the claim.

It is important to note that Akbank dava açma is not limited to individual customers. Businesses that have accounts or partnerships with Akbank can also initiate legal action if they encounter disputes. Whether it is a disagreement over loan terms, interest rates, or service charges, the process remains largely the same. By understanding the legal basis and procedures involved, individuals and businesses can navigate the system more effectively and increase their chances of a favorable outcome.

Why Should You Consider Filing a Lawsuit Against Akbank?

Filing a lawsuit against Akbank may seem like a daunting task, but there are several compelling reasons why it might be the right course of action. First and foremost, it provides a legal avenue to address grievances that have not been resolved through conventional means, such as customer service complaints or internal dispute resolution mechanisms. If you have exhausted all other options and still feel that your concerns have not been adequately addressed, Akbank dava açma can be a powerful tool to ensure accountability and fairness.

Another reason to consider filing a lawsuit is the potential for compensation. If you have suffered financial losses due to Akbank's actions or negligence, a successful lawsuit can help you recover damages. For example, if unauthorized transactions have occurred in your account or if you were misled about the terms of a financial product, a lawsuit can hold Akbank accountable and provide restitution. Additionally, filing a lawsuit can serve as a deterrent, encouraging the bank to improve its practices and treat customers more fairly in the future.

Finally, taking legal action can also help raise awareness about broader issues within the banking system. By filing a lawsuit, you contribute to a larger conversation about consumer rights and corporate responsibility. This can lead to systemic changes that benefit not only you but also other customers who may face similar challenges. In this way, Akbank dava açma is not just about seeking justice for yourself but also about advocating for a more transparent and equitable financial system.

Read also:Mitsuri R34 Exploring The Enigma Behind The Trend

Step-by-Step Guide to Initiating Akbank Dava Açma

Initiating Akbank dava açma involves a series of well-defined steps that ensure your case is presented effectively in court. Each step is critical to the success of your lawsuit, and understanding them thoroughly can significantly improve your chances of a favorable outcome. Below, we break down the process into manageable stages, providing detailed guidance for each.

Step 1: Understand the Legal Basis

Before you can file a lawsuit, it is essential to understand the legal grounds on which your case will be based. This involves familiarizing yourself with Turkish banking and consumer protection laws, which outline the rights and obligations of both customers and financial institutions. For instance, if you are filing a lawsuit due to unauthorized transactions, you may need to refer to specific articles in the Turkish Commercial Code or the Consumer Protection Law. Consulting with a legal expert or attorney who specializes in banking disputes can provide valuable insights and help you build a strong case.

Step 2: Gather Evidence and Documents

Once you have identified the legal basis for your lawsuit, the next step is to gather all relevant evidence and documents. This includes bank statements, transaction records, correspondence with Akbank, and any other documentation that supports your claim. Organizing these materials systematically can make a significant difference in how your case is perceived by the court. Additionally, it is advisable to create a timeline of events to provide a clear narrative of the issue. This can help the court understand the sequence of events and the impact of Akbank's actions on your financial situation.

Key Documents to Collect:

- Bank statements and transaction records

- Correspondence with Akbank's customer service

- Contracts or agreements with Akbank

- Any evidence of financial losses or damages

By following these steps diligently, you can ensure that your Akbank dava açma process is well-prepared and legally sound. This preparation not only increases your chances of success but also demonstrates your commitment to resolving the issue fairly and transparently.

What Are Your Rights as an Akbank Customer?

As an Akbank customer, you are entitled to a range of rights designed to protect you from unfair practices and ensure transparency in your banking experience. Understanding these rights is crucial, especially when considering Akbank dava açma. One of the most fundamental rights is the right to accurate and timely information. Akbank is obligated to provide clear and comprehensive details about its products, services, fees, and terms. This includes disclosing any changes to account conditions or interest rates well in advance, allowing you to make informed decisions about your finances.

Another critical right is the ability to file complaints and seek redress for issues you encounter. Akbank has a dedicated customer service department to address grievances, and you have the right to expect a prompt and fair resolution. If your complaint remains unresolved or if you feel that Akbank has not handled your case appropriately, you can escalate the matter by filing a lawsuit. This process not only holds the bank accountable but also ensures that your concerns are addressed through legal channels.

Finally, as a customer, you have the right to privacy and data protection. Akbank is required to safeguard your personal and financial information, ensuring it is not misused or shared without your consent. If you suspect a breach of this right, such as unauthorized access to your account or misuse of your data, you have the legal standing to pursue Akbank dava açma. By exercising these rights, you can protect your interests and contribute to a more equitable banking environment.

Common Reasons for Filing a Lawsuit Against Akbank

There are several common scenarios that lead individuals and businesses to consider Akbank dava açma. One frequent issue is unauthorized transactions, where customers discover charges or withdrawals from their accounts that they did not authorize. Such incidents can occur due to fraud, system errors, or even negligence on the part of the bank. In these cases, customers often seek legal recourse to recover their lost funds and ensure that proper security measures are implemented to prevent future occurrences.

Another prevalent reason for filing a lawsuit is disputes over loan agreements or credit terms. Customers may feel misled by unclear terms or unexpected changes in interest rates, leading to financial strain. For businesses, disagreements over commercial loans or credit lines can also escalate into legal action if Akbank fails to honor the agreed-upon terms. These disputes highlight the importance of transparency and accountability in banking practices, making Akbank dava açma a necessary step for many affected parties.

Finally, service-related issues, such as poor customer service or unresolved complaints, can also prompt legal action. When customers feel that their concerns are not being addressed adequately, they may choose to escalate the matter through a lawsuit. This not only seeks to resolve the immediate issue but also aims to hold Akbank accountable for maintaining high standards of customer care. By addressing these common reasons for Akbank dava açma, individuals and businesses can advocate for better practices and ensure fair treatment.

How Long Does the Akbank Dava Açma Process Take?

The duration of the Akbank dava açma process can vary significantly depending on several factors, including the complexity of the case, the court's schedule, and the responsiveness of both parties involved. On average, a straightforward case may take anywhere from six months to a year to reach a resolution. However, more complex disputes, such as those involving substantial financial claims or multiple parties, can extend the process to two years or more. Understanding these timelines is crucial for setting realistic expectations and planning accordingly.

Several factors can influence the length of the Akbank dava açma process. For instance, the court's workload and the availability of judges can cause delays, especially in busy jurisdictions. Additionally, the need for expert testimony or additional evidence can prolong proceedings, as these elements often require time to prepare and present. Furthermore, the responsiveness of Akbank and its legal team can also impact the timeline. If the bank contests the lawsuit vigorously or requests multiple extensions, it can significantly extend the duration of the case.

Despite these potential delays, there are steps you can take to expedite the process. Ensuring that all documentation is complete and accurate from the outset can help avoid unnecessary delays. Working with an experienced attorney who understands the intricacies of Akbank dava açma can also streamline proceedings by anticipating potential challenges and addressing them proactively. By staying organized and proactive, you can help ensure that your case progresses as efficiently as possible.

Frequently Asked Questions About Akbank Dava Açma

When considering Akbank dava açma, many individuals and businesses have questions about the process,

Discovering Sam Hoare: The Rising Star Of British Acting

Anirudh Ravichander USA Tour 2024: Everything You Need To Know

Exploring The World Of Will.Levis Video: A Complete Guide

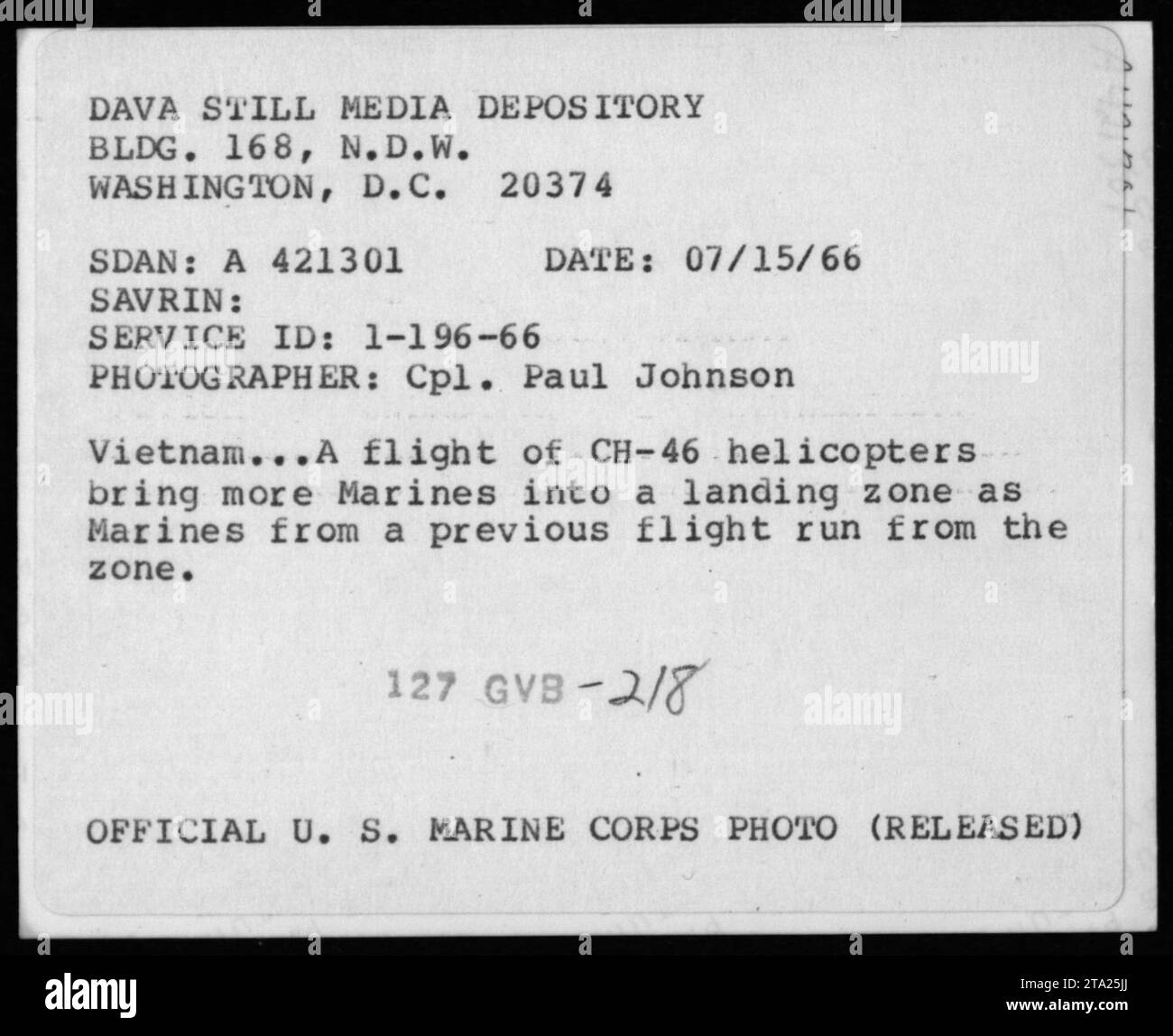

Dava Way 50k Images

Dava still media depository hires stock photography and images Alamy