Tapco Online Banking: A Comprehensive Guide To Digital Banking Solutions

With the increasing demand for convenience and security in banking, Tapco has positioned itself as a reliable platform that caters to both personal and business banking needs. From transferring funds to paying bills, this platform ensures that users have full control over their finances without the hassle of visiting a physical branch. Tapco’s commitment to user-friendly interfaces and robust security protocols makes it a standout choice for modern banking enthusiasts. In today’s fast-paced world, online banking platforms like Tapco are not just a luxury but a necessity. Whether you’re managing your savings, monitoring transactions, or applying for loans, Tapco Online Banking provides a suite of features designed to simplify your financial journey. The platform leverages cutting-edge technology to ensure that users experience minimal downtime, swift transaction processing, and real-time updates. By prioritizing customer satisfaction, Tapco has built a reputation for reliability and innovation in the banking sector, making it a trusted name among tech-savvy individuals and businesses alike. Beyond its core functionalities, Tapco Online Banking offers a range of value-added services, such as financial insights, budgeting tools, and personalized offers, which empower users to make informed financial decisions. The platform’s mobile compatibility ensures that you can stay connected to your finances on the go, whether you’re commuting, traveling, or simply relaxing at home. As we delve deeper into the features and benefits of Tapco Online Banking, it becomes evident why this platform has become a preferred choice for those seeking a secure, efficient, and modern banking experience.

Table of Contents

- What Makes Tapco Online Banking Stand Out?

- How Does Tapco Online Banking Enhance Security?

- Key Features of Tapco Online Banking

- Why Should You Switch to Tapco Online Banking?

- How to Get Started with Tapco Online Banking?

- Common Misconceptions About Online Banking

- Benefits of Using Tapco Online Banking for Businesses

- Frequently Asked Questions About Tapco Online Banking

What Makes Tapco Online Banking Stand Out?

Tapco Online Banking distinguishes itself through its commitment to innovation, user-centric design, and comprehensive service offerings. Unlike traditional banking systems, Tapco has embraced digital transformation to create a platform that not only meets but exceeds customer expectations. One of the standout features of Tapco is its intuitive interface, which ensures that even those new to online banking can navigate the platform with ease. From setting up recurring payments to managing multiple accounts, the platform’s design prioritizes simplicity without compromising on functionality.

Another factor that sets Tapco apart is its emphasis on personalization. The platform offers tailored financial insights and recommendations based on user behavior and transaction history. For instance, if you frequently overspend in a particular category, Tapco Online Banking will provide actionable tips to help you stay within your budget. Additionally, the platform’s integration with third-party financial tools allows users to consolidate their financial data in one place, offering a holistic view of their financial health. This level of customization is rare in the online banking space and highlights Tapco’s dedication to enhancing the user experience.

Read also:Exploring The Fascination With Big Titty A Comprehensive Guide

Tapco Online Banking also excels in its customer support services. The platform offers 24/7 assistance through multiple channels, including live chat, email, and phone support. This ensures that users can resolve their queries promptly, whether they’re troubleshooting a technical issue or seeking advice on financial planning. Furthermore, Tapco’s commitment to transparency is evident in its clear fee structures and detailed FAQs, which empower users to make informed decisions. By combining cutting-edge technology with a customer-first approach, Tapco Online Banking has carved a niche for itself in the competitive digital banking landscape.

How Does Tapco Online Banking Enhance Security?

Security is a top priority for Tapco Online Banking, and the platform employs a multi-layered approach to safeguard user data and transactions. One of the primary measures is multi-factor authentication (MFA), which requires users to verify their identity through multiple steps before accessing their accounts. This could include entering a password, receiving a one-time code on their mobile device, or using biometric authentication such as fingerprint or facial recognition. By adding these extra layers of protection, Tapco ensures that unauthorized access is virtually impossible.

In addition to MFA, Tapco Online Banking utilizes advanced encryption protocols to protect sensitive information during transmission. All data exchanged between the user’s device and the platform’s servers is encrypted using industry-standard algorithms, making it unreadable to potential hackers. Furthermore, the platform employs real-time fraud monitoring systems that detect suspicious activities, such as unusual login attempts or large transactions. If any anomalies are detected, users are immediately alerted via email or SMS, allowing them to take swift action to secure their accounts.

Another innovative security feature is the platform’s ability to log users out automatically after a period of inactivity. This prevents unauthorized access in case a user forgets to log out manually, especially when using public or shared devices. Tapco also provides users with the option to set up account-specific security questions and answers, adding an additional layer of protection. By combining these robust security measures, Tapco Online Banking instills confidence in its users, assuring them that their financial data is safe and secure at all times.

Key Features of Tapco Online Banking

Tapco Online Banking is packed with features designed to make financial management effortless and efficient. These features cater to a wide range of user needs, from everyday banking tasks to advanced financial planning. Below, we explore some of the standout functionalities that make Tapco a preferred choice for digital banking.

Real-Time Transaction Tracking

One of the most valuable features of Tapco Online Banking is its real-time transaction tracking capability. This feature allows users to monitor their account activity as it happens, providing immediate updates on deposits, withdrawals, and transfers. Whether you’re checking your balance after a purchase or verifying a payment, real-time tracking ensures that you always have the most up-to-date information. This transparency not only helps users stay on top of their finances but also enables them to detect and address any discrepancies promptly.

Read also:Unveiling The Overtime Megan Sectape Phenomenon A Deep Dive

Customizable Notifications

Tapco Online Banking also offers customizable notifications, which allow users to tailor their alerts based on their preferences. For example, you can set up notifications for low account balances, bill due dates, or large transactions. These alerts can be delivered via email, SMS, or push notifications, ensuring that you never miss an important update. By staying informed, users can avoid unnecessary fees, such as overdraft charges, and ensure that their financial obligations are met on time. This level of customization enhances the user experience and adds an extra layer of convenience to managing finances.

Why Should You Switch to Tapco Online Banking?

Switching to Tapco Online Banking offers numerous advantages that make it a compelling choice for individuals and businesses alike. One of the most significant benefits is the convenience it provides. With Tapco, you no longer need to visit a physical branch or wait in long queues to perform routine banking tasks. Whether you’re transferring funds, paying bills, or checking your account balance, everything can be done from the comfort of your home or on the go using your smartphone. This level of accessibility saves time and effort, allowing you to focus on other priorities.

Another compelling reason to switch is the cost savings associated with online banking. Traditional banks often charge fees for services such as check processing, account maintenance, and paper statements. Tapco Online Banking eliminates many of these costs by offering digital alternatives. For instance, users can opt for e-statements instead of paper ones, reducing clutter and environmental impact while saving money. Additionally, the platform’s budgeting tools and financial insights help users make smarter spending decisions, further enhancing their financial well-being.

Tapco Online Banking also offers a level of flexibility that traditional banks struggle to match. The platform is available 24/7, allowing users to manage their finances at any time, regardless of their schedule. Whether you’re an early riser or a night owl, Tapco ensures that your banking needs are met without any restrictions. Furthermore, the platform’s mobile compatibility ensures that you can stay connected to your finances even when you’re traveling or away from your computer. By combining convenience, cost savings, and flexibility, Tapco Online Banking provides a compelling case for making the switch.

How to Get Started with Tapco Online Banking?

Getting started with Tapco Online Banking is a straightforward process that can be completed in just a few simple steps. First, you’ll need to visit the official Tapco website or download the mobile app from your device’s app store. Once you’ve accessed the platform, look for the “Sign Up” or “Register” button, which will guide you through the account creation process. You’ll be required to provide some basic information, such as your name, email address, and a valid phone number. Additionally, you’ll need to link your existing bank account to your new Tapco profile to facilitate transactions.

After completing the registration process, you’ll need to verify your identity. This typically involves answering security questions or uploading identification documents, such as a driver’s license or passport. Tapco Online Banking takes identity verification seriously to ensure the safety of its users and comply with regulatory requirements. Once your identity is confirmed, you’ll gain full access to the platform’s features. It’s also recommended to set up multi-factor authentication during this stage to enhance the security of your account.

Finally, take some time to explore the platform and familiarize yourself with its features. Tapco offers a variety of tutorials and FAQs to help new users navigate the system effectively. You can also reach out to customer support if you encounter any issues or have questions about the platform. By following these steps, you’ll be well on your way to enjoying the convenience and efficiency of Tapco Online Banking.

Common Misconceptions About Online Banking

Despite its growing popularity, online banking platforms like Tapco are often surrounded by misconceptions that deter potential users. Addressing these myths is essential to help individuals make informed decisions about adopting digital banking solutions. Below, we debunk two of the most common misconceptions about online banking.

Is Online Banking Safe?

One of the most pervasive myths about online banking is that it’s inherently unsafe. While it’s true that digital platforms can be vulnerable to cyber threats, reputable platforms like Tapco Online Banking employ robust security measures to protect user data. From multi-factor authentication to end-to-end encryption, Tapco ensures that your financial information remains secure at all times. Additionally, users can take proactive steps to enhance their security, such as using strong passwords and avoiding public Wi-Fi for sensitive transactions. By understanding these safeguards, users can confidently embrace online banking without fear of compromise.

Does Online Banking Replace Physical Branches?

Another common misconception is that online banking eliminates the need for physical branches entirely. While it’s true that digital platforms like Tapco offer unparalleled convenience, physical branches still play a crucial role in the banking ecosystem. For instance, certain services, such as notarized document signings or complex loan consultations, may require in-person interactions. Tapco Online Banking complements traditional banking by offering an additional layer of accessibility, rather than replacing it entirely. This hybrid approach ensures that users have the flexibility to choose the service delivery method that best suits their needs.

Benefits of Using Tapco Online Banking for Businesses

Tapco Online Banking is not just for individual users; it also offers a range of benefits tailored specifically for businesses. One of the most significant advantages is the platform’s ability to streamline financial operations. Businesses can manage multiple accounts, process payroll, and handle vendor payments all from a single interface. This eliminates the need for manual record-keeping and reduces the risk of errors, allowing business owners to focus on growth and innovation. Additionally, Tapco’s real-time transaction tracking feature provides business owners with instant visibility into their cash flow, enabling them to make

Exploring The Shanghai Sharks Meme: Origins, Evolution, And Cultural Impact

Del Pino CNE: Everything You Need To Know About This Influential Figure

Exploring Shirogane Sama NSFW: A Comprehensive Guide

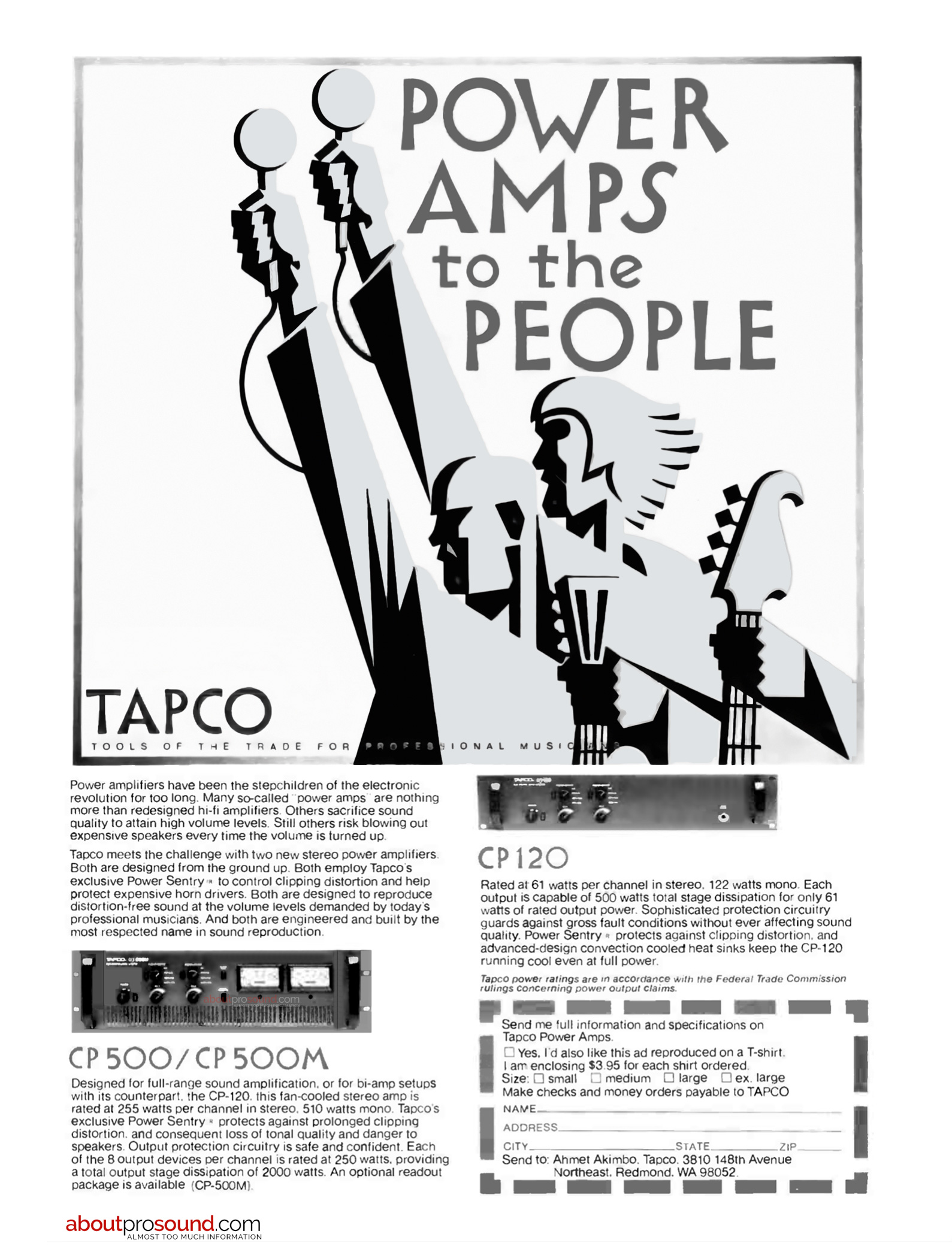

1977 Tapco Amps Ad About ProSound Interesting stuff in the realms

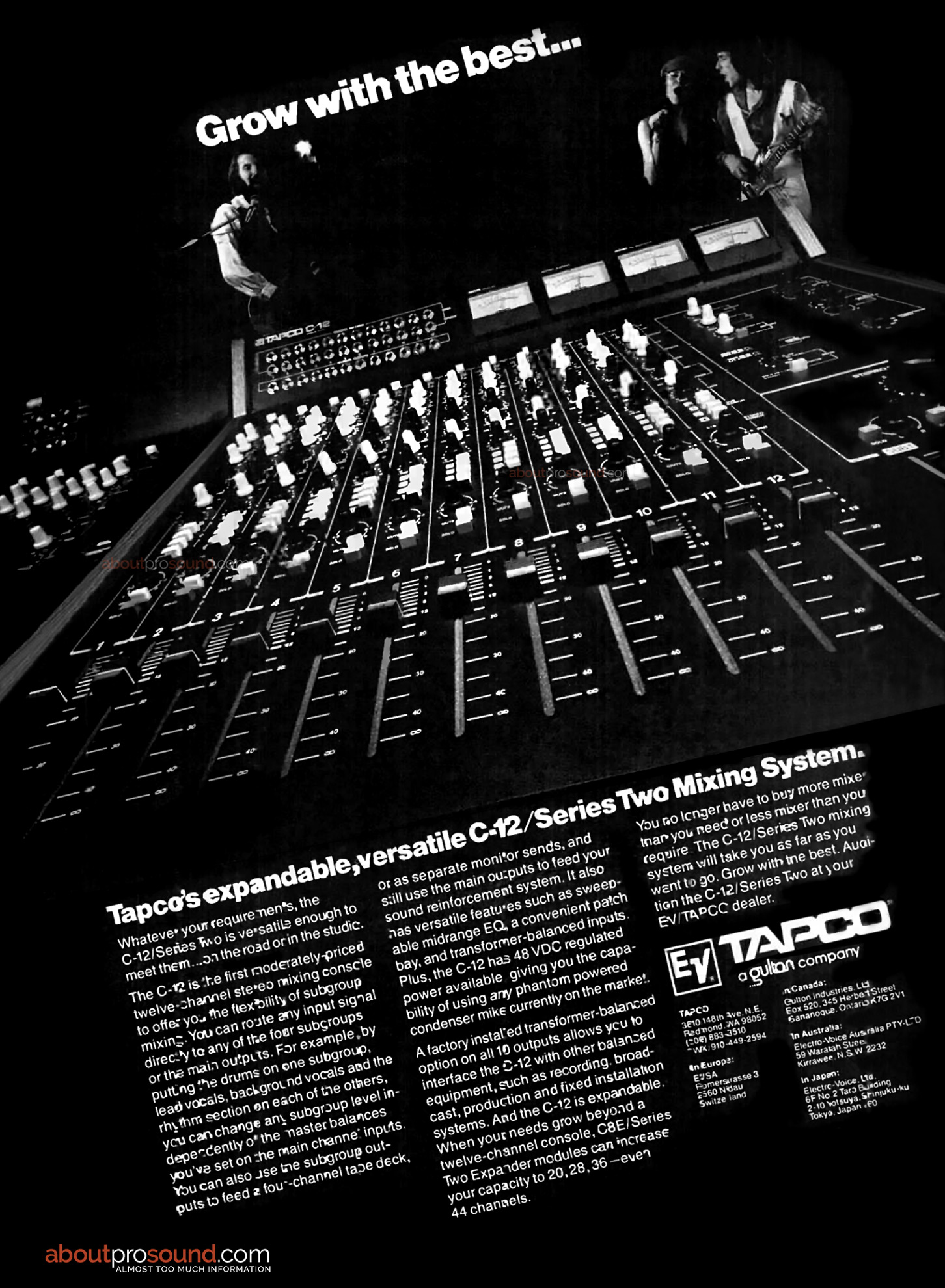

1981 EV Tapco C12 Series Ad About ProSound Interesting stuff in