Who Is Jeffrey Snider? Unveiling The Expert Behind Economic Insights

Jeffrey Snider is a name synonymous with deep economic analysis and innovative financial perspectives. As a leading voice in the world of economics, Snider has carved a niche for himself by challenging conventional wisdom and offering alternative explanations for global financial trends. His work, which spans decades, focuses on dissecting monetary policies, central banking, and the intricacies of global markets. With a reputation for clarity and precision, Jeffrey Snider has become a trusted figure for those seeking to understand the complexities of modern economics.

What sets Jeffrey Snider apart is his ability to break down complex economic theories into digestible insights for both experts and laypeople alike. His expertise lies in identifying patterns and anomalies within financial systems, often shedding light on overlooked aspects of economic data. Through his writings, podcasts, and public appearances, Snider has consistently demonstrated an unparalleled understanding of macroeconomic trends, making him a go-to resource for investors, policymakers, and curious minds. His work is not just about numbers; it’s about understanding the human and systemic forces that drive economies.

As we delve deeper into the life and contributions of Jeffrey Snider, it’s essential to recognize his role as a thought leader in the financial world. Whether you’re familiar with his name or encountering it for the first time, this article aims to provide a comprehensive overview of his biography, career, and impact. From his early days to his current status as a respected economist, we’ll explore how Snider’s journey has shaped his unique perspective and why his insights matter in today’s ever-evolving economic landscape.

Read also:Exploring The Phenomenon Of Girthmasterr Jeffree Star A Deep Dive Into His World

Table of Contents

- Biography of Jeffrey Snider

- How Did Jeffrey Snider Begin His Career?

- What Are Jeffrey Snider's Key Contributions to Economics?

- Why Does Jeffrey Snider Criticize Modern Monetary Policy?

- How Does Jeffrey Snider Analyze Global Markets?

- What Makes Jeffrey Snider’s Podcasts a Must-Listen?

- What Is Jeffrey Snider’s Lasting Legacy in Economics?

- Frequently Asked Questions About Jeffrey Snider

Biography of Jeffrey Snider

| Full Name | Jeffrey Snider |

|---|---|

| Date of Birth | Not Publicly Disclosed |

| Profession | Economist, Financial Analyst, Writer |

| Education | Not Publicly Disclosed |

| Notable Work | Alhambra Investments, Eurodollar University |

| Areas of Expertise | Monetary Policy, Central Banking, Global Markets |

Jeffrey Snider’s biography is a testament to his dedication to understanding and explaining the complexities of economics. While specific details about his early life and education remain private, his professional journey speaks volumes about his expertise. Snider began his career in finance, where he quickly developed a reputation for his ability to interpret economic data and trends. Over the years, he has worked with various institutions, including Alhambra Investments, where he serves as the Head of Global Research. His role involves analyzing global financial systems and providing insights that challenge mainstream economic narratives.

Snider’s work is characterized by a deep focus on monetary policy and central banking, areas where he has consistently offered alternative perspectives. His writings and analyses often delve into the Eurodollar system, a topic he has extensively covered through his Eurodollar University series. This initiative has become a cornerstone of his contributions, offering detailed explanations of how global liquidity and banking systems function. Through his research, Snider has highlighted the limitations of traditional economic models, advocating for a more nuanced understanding of financial dynamics.

What makes Jeffrey Snider’s biography particularly compelling is his ability to bridge the gap between academic theory and real-world application. His insights are not confined to academic journals but are shared widely through articles, podcasts, and public speaking engagements. This accessibility has made him a trusted voice for those seeking clarity in an often opaque field. As we explore his career further, it becomes evident that Snider’s journey is not just about personal success but about reshaping how we understand economics.

How Did Jeffrey Snider Begin His Career?

Jeffrey Snider’s early career laid the foundation for his later success as a financial analyst and economist. While details about his educational background remain undisclosed, it’s clear that his entry into the world of finance was marked by a keen interest in understanding the mechanics of global markets. His initial roles involved analyzing financial data and identifying trends, skills that would later define his approach to economics. During this period, Snider developed a reputation for his meticulous attention to detail and his ability to connect seemingly unrelated economic indicators.

What Role Did Alhambra Investments Play in His Career?

One of the pivotal moments in Jeffrey Snider’s career was his association with Alhambra Investments. As the Head of Global Research, Snider was tasked with providing in-depth analyses of global financial systems. This role allowed him to refine his expertise in monetary policy and central banking, areas that would become central to his work. At Alhambra, Snider’s research often challenged conventional economic theories, offering alternative explanations for market behavior. His insights into the Eurodollar system, for instance, have been widely regarded as groundbreaking, shedding light on the complexities of global liquidity.

How Did Snider’s Early Work Shape His Analytical Style?

Snider’s early career was instrumental in shaping his analytical style, which emphasizes data-driven insights and a contrarian approach to economic narratives. Unlike many economists who rely on established models, Snider often questions the assumptions underlying these frameworks. This approach has earned him a reputation as a critical thinker who is unafraid to challenge the status quo. His early work also highlighted the importance of understanding the interconnectedness of global markets, a theme that continues to resonate in his analyses today.

Read also:Who Is David D Chapman A Comprehensive Guide To His Life And Achievements

What Are Jeffrey Snider's Key Contributions to Economics?

Jeffrey Snider’s contributions to economics are as diverse as they are impactful. At the heart of his work is a focus on monetary policy and the Eurodollar system, areas where he has consistently offered fresh perspectives. His Eurodollar University series, for instance, has become a go-to resource for those seeking to understand the intricacies of global liquidity. Through this initiative, Snider has demystified the workings of the Eurodollar market, explaining how it influences everything from interest rates to international trade.

Why Is Snider’s Work on Central Banking So Influential?

One of Jeffrey Snider’s most significant contributions is his critique of modern central banking practices. He has argued that central banks often misunderstand the dynamics of global markets, leading to policies that fail to achieve their intended outcomes. Snider’s analyses have highlighted the limitations of tools like quantitative easing, suggesting that they often fall short of addressing underlying economic issues. His work has sparked important conversations about the role of central banks in shaping economic stability, making him a respected voice in policy circles.

How Has Snider Influenced Public Understanding of Economics?

Beyond his technical contributions, Jeffrey Snider has played a key role in making economics more accessible to the public. Through his writings and podcasts, he has broken down complex economic concepts into relatable insights. This effort has empowered individuals to engage with economic issues more meaningfully, fostering a broader understanding of global financial systems. Snider’s ability to communicate complex ideas in simple terms has solidified his status as a thought leader in economics.

Why Does Jeffrey Snider Criticize Modern Monetary Policy?

Jeffrey Snider’s critique of modern monetary policy is rooted in his belief that traditional models often fail to account for the complexities of global markets. He has consistently argued that central banks, including the Federal Reserve, rely on outdated frameworks that do not reflect the realities of today’s interconnected financial systems. For instance, Snider has pointed out that policies like quantitative easing, while well-intentioned, often fail to address the root causes of economic instability. Instead, they may create distortions in asset markets, leading to unintended consequences.

What Are the Flaws in Current Monetary Policy Frameworks?

Snider’s analysis highlights several flaws in current monetary policy frameworks. One key issue is the over-reliance on interest rates as a tool for managing economic growth. He argues that this approach overlooks the role of liquidity and credit in driving market dynamics. Additionally, Snider has criticized the lack of transparency in central bank decision-making, suggesting that it undermines public trust in these institutions. His insights have sparked important debates about the need for more adaptive and transparent monetary policies.

How Can Monetary Policy Be Improved According to Snider?

According to Jeffrey Snider, improving monetary policy requires a more nuanced understanding of global financial systems. He advocates for policies that prioritize liquidity and credit availability over simplistic interest rate adjustments. Snider also emphasizes the importance of transparency, urging central banks to communicate their decisions more clearly to the public. By adopting these changes, he believes that monetary policy can become more effective in promoting sustainable economic growth.

How Does Jeffrey Snider Analyze Global Markets?

Jeffrey Snider’s approach to analyzing global markets is characterized by a focus on interconnectedness and systemic risks. He often examines how liquidity flows and credit conditions influence market behavior, offering insights that go beyond traditional economic indicators. For example, Snider has highlighted the role of the Eurodollar system in shaping global financial stability, arguing that disruptions in this system can have far-reaching consequences. His analyses provide a comprehensive view of how various factors interact to drive market trends.

What Are the Key Drivers of Market Trends According to Snider?

According to Snider, the key drivers of market trends include liquidity, credit availability, and global trade dynamics. He has argued that these factors often outweigh the influence of traditional indicators like GDP growth or employment rates. By focusing on these drivers, Snider offers a more holistic understanding of market behavior, helping investors and policymakers make informed decisions. His insights have proven invaluable in navigating the complexities of modern financial systems.

How Does Snider Predict Market Shifts?

Snider’s ability to predict market shifts lies in his data-driven approach and contrarian mindset. He often looks for anomalies in economic data, using them as signals of potential changes in market trends. This method has allowed him to anticipate shifts that others might overlook, earning him a reputation as a forward-thinking analyst. By combining rigorous analysis with a willingness to challenge conventional wisdom, Snider continues to provide valuable insights into global markets.

What Makes Jeffrey Snider’s Podcasts a Must-Listen?

Jeffrey Snider’s podcasts have become a staple for anyone interested in economics and finance. Through these platforms, he shares his insights in an engaging and accessible manner, making complex topics relatable to a wide audience. His ability to break down intricate economic concepts into digestible content has earned his podcasts a loyal following. Whether discussing monetary policy, global markets, or central banking, Snider’s podcasts offer a unique blend of expertise and clarity.

How Do Snider’s Podcasts Stand Out from Others?

What sets Jeffrey Snider’s podcasts apart is his focus on alternative perspectives and contrarian viewpoints. Unlike many financial podcasts that reinforce mainstream narratives, Snider challenges conventional wisdom, encouraging listeners to think critically about economic issues. His podcasts also feature interviews with other experts, providing a diverse range of insights. This approach has made his podcasts a trusted resource for those seeking a deeper understanding of economics.

What Topics Does Snider Cover in His Podcasts?

Snider’s podcasts cover a wide range of topics, from the intricacies of the Eurodollar system to the implications of monetary policy decisions. He also delves into global market trends, offering timely analyses of current events. Whether discussing the impact of geopolitical developments or the role of central banks, Snider’s podcasts provide valuable insights that resonate with both experts and beginners alike.

What Is Jeffrey Snider’s Lasting Legacy in Economics?

Jeffrey Snider’s lasting legacy in economics lies in his ability to challenge conventional wisdom and offer alternative perspectives. His work has reshaped how we understand monetary policy, central banking, and global markets, providing a more nuanced view of economic dynamics. By making complex topics accessible and fostering critical thinking, Snider has left an indelible mark on the field of economics.

Frequently Asked Questions About Jeffrey Snider

Who is Jeffrey Snider and Why Is He Important?

Jeffrey Snider is a renowned economist and financial analyst known for his expertise in monetary policy and global markets. His importance lies in

Understanding The Impact Of Colmillos De Cocaína: What You Need To Know

Exploring The World Of Ebony Thick Solo: A Comprehensive Guide

Unlocking The Potential Of Derek Betr Media: A Comprehensive Guide

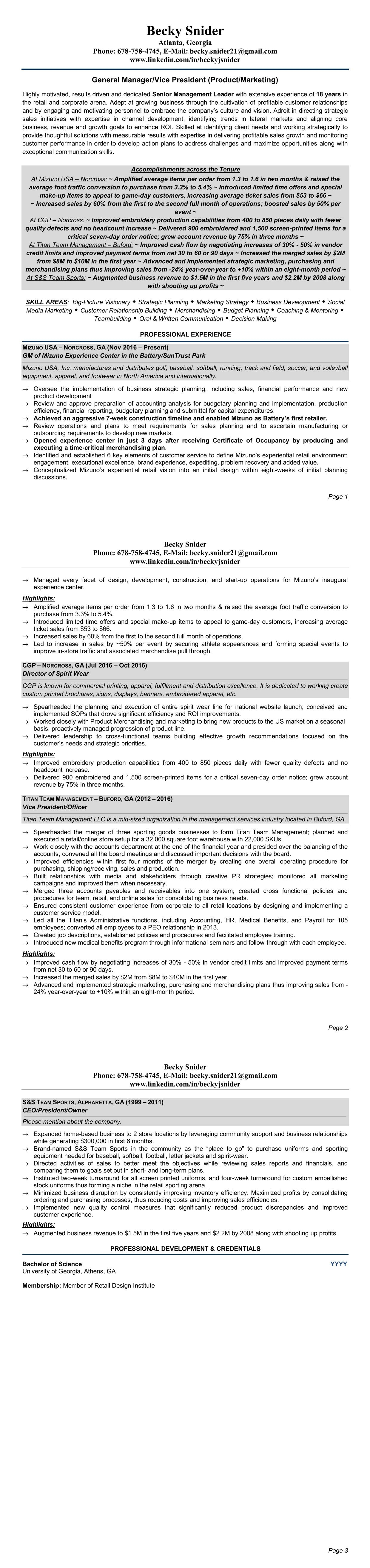

Becky Snider Resume Career Growth

Jeffrey Baldinger