Unveiling The Secrets Of Wall Street.Silcer: A Comprehensive Guide

Whether you're a seasoned investor or a curious beginner, understanding the intricacies of Wall Street.Silcer is essential for navigating the complexities of today's financial markets. From its mysterious origins to its influence on global economies, this phenomenon has reshaped how we perceive investments and wealth creation. Its ability to adapt to changing market conditions and technological advancements has made it a cornerstone of modern financial discussions. As we delve deeper into Wall Street.Silcer, it becomes evident that its impact extends far beyond traditional trading floors. It has revolutionized how individuals and institutions approach investments, risk management, and wealth accumulation. The integration of cutting-edge technology and innovative strategies has created a new paradigm in financial markets. This transformation has not only democratized access to investment opportunities but also raised important questions about market stability, regulatory frameworks, and ethical considerations in modern finance. The significance of Wall Street.Silcer in today's financial landscape cannot be overstated. Its influence permeates various aspects of global economics, from individual wealth management to institutional investment strategies. As we explore its multifaceted nature, we'll uncover how this phenomenon has become a catalyst for change in the financial world, challenging traditional norms while creating unprecedented opportunities for growth and innovation. Understanding its mechanisms and implications is crucial for anyone seeking to thrive in the ever-evolving world of finance.

Table of Contents

- What is Wall Street.Silcer and Why Does It Matter?

- The Historical Evolution of Wall Street.Silcer

- How Does Wall Street.Silcer Work?

- What Impact Does Wall Street.Silcer Have on Global Markets?

- What Are the Benefits and Challenges of Wall Street.Silcer?

- Future Trends in Wall Street.Silcer Technology

- The Regulatory Landscape Surrounding Wall Street.Silcer

- Practical Applications of Wall Street.Silcer in Everyday Investing

What is Wall Street.Silcer and Why Does It Matter?

Wall Street.Silcer represents a revolutionary approach to financial markets that has transformed traditional investment paradigms. At its core, it encompasses a sophisticated system of market analysis, algorithmic trading, and predictive modeling that leverages advanced technology to optimize investment decisions. The term "Silcer" itself is derived from the combination of "silicon" and "trader," reflecting its foundation in technological innovation and financial expertise. This unique fusion has created a powerful tool that enables investors to navigate complex market conditions with unprecedented precision and efficiency.

The importance of Wall Street.Silcer in modern finance stems from its ability to process vast amounts of market data in real-time. Through sophisticated algorithms and machine learning capabilities, it can identify patterns, predict market movements, and execute trades with remarkable accuracy. This technological advantage has democratized access to high-level financial insights, allowing both institutional investors and individual traders to make informed decisions based on comprehensive market analysis. The system's adaptability to changing market conditions has proven particularly valuable in today's volatile economic environment, where traditional investment strategies often fall short.

Read also:Exploring The Fascinating World Of Hung Thai Ladyboys A Comprehensive Guide

Several key features distinguish Wall Street.Silcer from conventional trading approaches. First, its integration of artificial intelligence allows for continuous learning and adaptation, enabling the system to evolve alongside market dynamics. Second, its comprehensive data analysis capabilities provide a holistic view of market conditions, incorporating everything from macroeconomic indicators to micro-level trading patterns. Third, its execution speed and precision have set new standards in trade efficiency, often completing transactions in milliseconds. These features have collectively contributed to Wall Street.Silcer's growing prominence in financial circles, making it an indispensable tool for modern investors seeking to maintain a competitive edge in increasingly complex markets.

The Historical Evolution of Wall Street.Silcer

The journey of Wall Street.Silcer began in the early 2000s, coinciding with the rapid advancement of computational technology and the proliferation of high-speed internet. Initially, it emerged as a modest algorithmic trading system developed by a group of Wall Street quantitative analysts who sought to leverage computing power for market analysis. These pioneers recognized the potential of combining traditional financial expertise with emerging technological capabilities, laying the groundwork for what would become a revolutionary approach to trading and investment management.

The evolution of Wall Street.Silcer can be divided into three distinct phases. The first phase (2001-2008) focused primarily on basic pattern recognition and automated trading execution. During this period, the system's developers refined its ability to process historical market data and identify recurring patterns. The 2008 financial crisis marked a turning point, as the limitations of traditional investment strategies became glaringly apparent. This led to the second phase (2009-2015), characterized by significant enhancements in risk management protocols and predictive analytics. The system's architecture was fundamentally restructured to incorporate real-time data processing and machine learning capabilities.

The third and current phase (2016-present) has witnessed the transformation of Wall Street.Silcer into a comprehensive financial ecosystem. Key milestones include the integration of artificial intelligence in 2017, which enabled the system to learn from market events and adapt its strategies accordingly. In 2019, the introduction of blockchain technology enhanced transparency and security in transaction processing. The global pandemic of 2020 accelerated adoption rates as investors sought more reliable and efficient trading solutions. Today, Wall Street.Silcer represents a sophisticated network of interconnected systems that not only execute trades but also provide strategic insights and portfolio management recommendations.

How Has Wall Street.Silcer Influenced Trading Strategies?

The impact of Wall Street.Silcer on trading strategies has been nothing short of transformative. Traditional approaches that relied heavily on human intuition and historical analysis have gradually given way to data-driven decision-making processes. The system's ability to process millions of data points simultaneously has fundamentally altered how traders approach market analysis. Instead of focusing on isolated indicators, traders can now leverage comprehensive market views that incorporate multiple variables and their interrelationships.

Several key changes have emerged in trading strategies due to Wall Street.Silcer's influence. First, the concept of "time horizon" has evolved significantly. While traditional strategies often operated on daily or weekly cycles, Wall Street.Silcer has enabled the development of micro-strategies that operate on minute or even second-long intervals. Second, risk management has become more sophisticated, with the system's predictive capabilities allowing for dynamic position adjustments based on real-time market conditions. Third, portfolio diversification strategies have become more nuanced, as the system can identify correlations and opportunities across asset classes that were previously undetectable.

Read also:Lexie Beth The Rising Star You Need To Know About

What Are the Key Milestones in Wall Street.Silcer's Development?

Several pivotal moments have marked Wall Street.Silcer's development journey. In 2012, the introduction of neural networks significantly enhanced its pattern recognition capabilities. The following year saw the implementation of sentiment analysis tools that incorporated social media data into market predictions. 2016 witnessed the integration of quantum computing elements, which dramatically increased processing power and enabled more complex simulations. The launch of the Wall Street.Silcer Academy in 2018 marked another significant milestone, as it established formal training programs for financial professionals seeking to master the system.

How Does Wall Street.Silcer Work?

Understanding the inner workings of Wall Street.Silcer requires examining its sophisticated architecture and operational framework. At its foundation lies a multi-layered system that integrates various technological components, each playing a crucial role in its overall functionality. The system's core architecture consists of three primary layers: data acquisition, processing, and execution. The data acquisition layer employs a network of high-speed servers that collect real-time market information from multiple sources, including stock exchanges, financial news outlets, and social media platforms. This comprehensive data collection ensures that the system maintains a complete and up-to-date picture of market conditions.

The processing layer represents the heart of Wall Street.Silcer's capabilities, where advanced algorithms and machine learning models analyze the collected data. This layer utilizes several key technologies to transform raw data into actionable insights. First, natural language processing (NLP) algorithms interpret textual information from news articles and social media posts, extracting relevant market sentiment and trends. Second, pattern recognition algorithms identify recurring market behaviors and correlations across different asset classes. Third, predictive modeling tools use historical data and current market conditions to forecast potential market movements. The integration of these technologies enables Wall Street.Silcer to generate sophisticated market analyses that traditional methods simply cannot match.

The execution layer translates the system's analyses into concrete trading actions. This layer employs high-frequency trading algorithms that can execute trades at optimal moments, often within milliseconds. The execution process involves several critical steps: first, the system evaluates potential trade opportunities against predefined risk parameters; second, it calculates optimal trade sizes and timing; third, it executes trades through multiple brokerage channels to ensure best price execution. The entire process is governed by sophisticated risk management protocols that automatically adjust positions based on real-time market conditions and volatility levels.

What Makes Wall Street.Silcer's Technology Unique?

Several distinctive features set Wall Street.Silcer's technology apart from other financial systems. First, its adaptive learning capability allows the system to continuously improve its performance based on market feedback and new data. This self-evolving nature ensures that Wall Street.Silcer remains effective even as market conditions change. Second, its modular architecture enables seamless integration of new technologies and data sources, allowing the system to stay at the forefront of financial innovation. Third, its distributed computing infrastructure provides unparalleled processing power while maintaining system redundancy and reliability.

How Does Wall Street.Silcer Maintain Market Relevance?

Wall Street.Silcer's ability to maintain market relevance stems from its commitment to continuous improvement and innovation. The system undergoes regular updates that incorporate the latest advancements in artificial intelligence, machine learning, and financial theory. Its developers maintain close relationships with academic institutions and research organizations, ensuring that cutting-edge financial concepts are quickly integrated into the system's framework. Additionally, Wall Street.Silcer's extensive network of users provides valuable feedback that informs system enhancements and feature developments.

What Impact Does Wall Street.Silcer Have on Global Markets?

The influence of Wall Street.Silcer extends far beyond individual trading desks, significantly impacting global financial markets and economic systems. One of the most profound effects has been the increased market efficiency resulting from its sophisticated analysis capabilities. By processing vast amounts of data and executing trades with unprecedented speed, Wall Street.Silcer has helped reduce market inefficiencies and arbitrage opportunities. This enhanced efficiency has led to more accurate price discovery mechanisms, benefiting both institutional investors and retail traders alike.

On a macroeconomic level, Wall Street.Silcer has contributed to the globalization of financial markets by facilitating cross-border investments and currency trading. Its ability to analyze multiple markets simultaneously has made it easier for investors to diversify their portfolios across different geographic regions. This increased interconnectedness has, however, also introduced new challenges, particularly in terms of market volatility transmission. The rapid execution capabilities of Wall Street.Silcer can sometimes amplify market movements, leading to flash crashes or sudden price spikes that ripple across global markets.

The system's impact on market liquidity has been particularly noteworthy. By providing continuous bid-ask spreads and maintaining order books across multiple exchanges, Wall Street.Silcer has enhanced market depth and stability. This increased liquidity has made it easier for large institutional investors to execute significant trades without substantially moving the market. However, the concentration of trading activity through Wall Street.Silcer has also raised concerns about market concentration and systemic risk, prompting regulatory bodies to closely monitor its operations.

How Has Wall Street.Silcer Influenced Global Economic Policies?

The rise of Wall Street.Silcer has forced governments and central banks to reconsider their approaches to monetary policy and financial regulation. Traditional policy tools have proven less effective in markets dominated by algorithmic trading systems. Central banks now must account for the rapid response times of systems like Wall Street.Silcer when implementing interest rate changes or quantitative easing measures. This has led to more gradual policy adjustments and increased communication with market participants to prevent sudden market disruptions.

What Are the Geopolitical Implications of Wall Street.Silcer?

The global adoption of Wall Street.Silcer has introduced new dimensions to international financial relations. Countries with advanced technological infrastructure have gained competitive advantages in financial markets, while those lagging in technological development face challenges in maintaining their financial sectors' competitiveness. This technological divide has become a significant factor in international economic diplomacy, with nations increasingly investing in financial technology development to remain relevant in the global market landscape.

What Are the Benefits and Challenges of Wall Street.Silcer?

The adoption of Wall Street.Silcer presents a complex array of advantages and disadvantages that investors and financial institutions must carefully consider. On the benefits side, the system's most significant advantage lies in its ability to process and analyze vast amounts of data far beyond human capability. This computational power enables users to identify profitable trading opportunities that might otherwise go unnoticed, potentially leading to enhanced returns on investment

Unveiling The Phenomenon: Kpop Idol Bulge And Its Cultural Impact

Discover The Timeless Elegance Of The Gibson London: A Style Icon

Tetchie Agbayani Height: A Complete Guide To Her Life And Career

Cleveland Cavaliers Announce Class of 2024 Wall of Honor Inductees

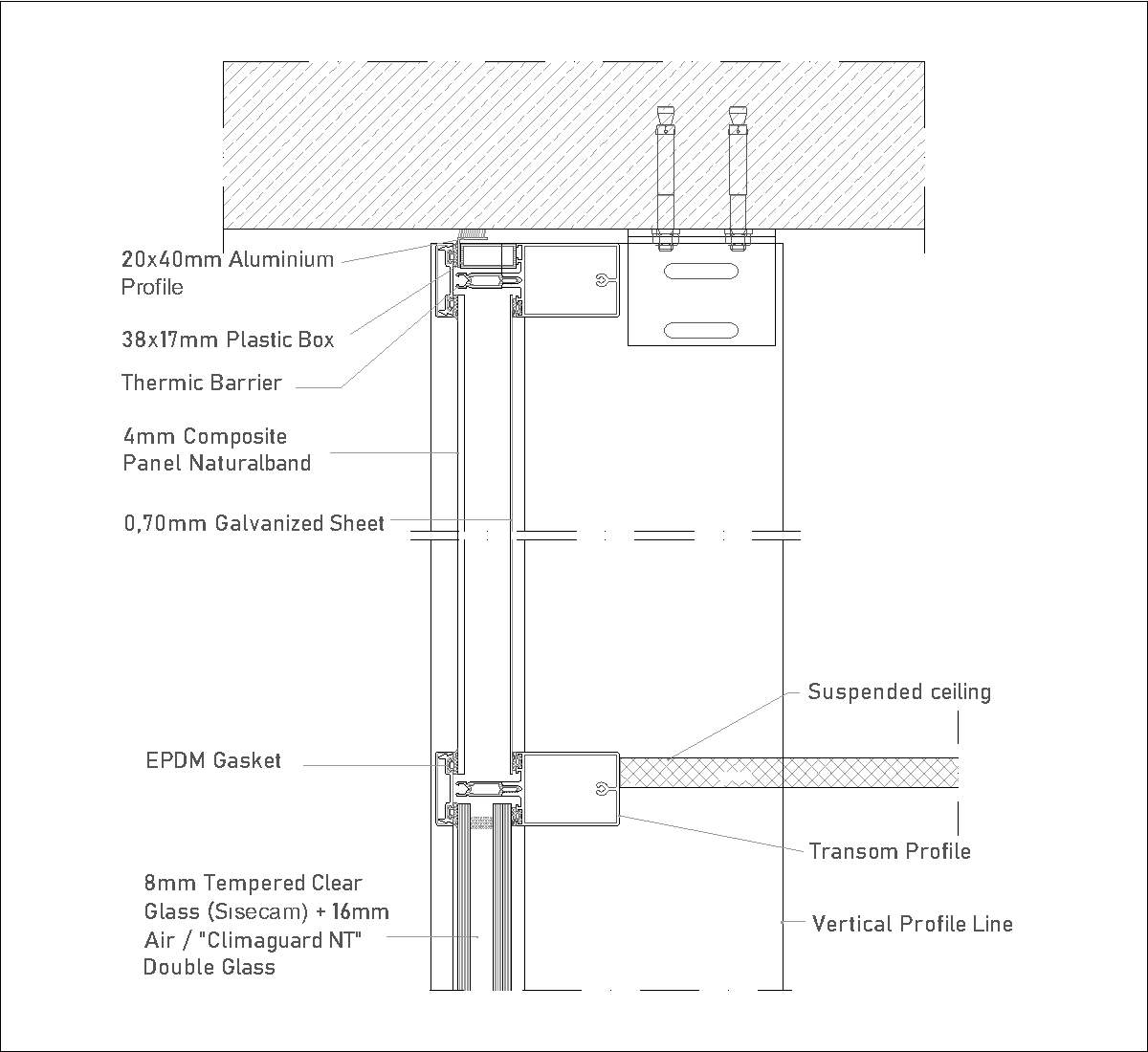

Curtain Wall System Details Dwg