Understanding Taxes And Titties: A Comprehensive Guide

Have you ever wondered how taxes and titties intersect in our modern world? Taxes are a fundamental aspect of society, funding public services and infrastructure that keep our communities running smoothly. On the other hand, "titties," often associated with humor or entertainment, have become a cultural phenomenon that sparks discussions about societal norms, gender equality, and even economic trends. While these two topics may seem unrelated at first glance, they both play significant roles in shaping public discourse and policy decisions. This article delves into the intricate connections between these seemingly disparate subjects, exploring how they influence each other and what they reveal about our society.

From a financial perspective, taxes are the backbone of any functioning economy, ensuring that governments have the resources to provide essential services. But when we bring "titties" into the conversation, things get interesting. Whether it’s the economic impact of industries tied to adult entertainment or the cultural implications of how women’s bodies are perceived, these topics provoke thought and debate. By examining both, we can gain a deeper understanding of how societal values, economic systems, and cultural norms interact in unexpected ways.

As we explore the nuances of taxes and titties, we’ll uncover surprising insights and address common misconceptions. This article is designed to be both informative and engaging, offering a fresh perspective on these topics while maintaining a tone that’s accessible and thought-provoking. Whether you’re curious about the economic implications of adult industries or simply intrigued by how taxes affect various sectors, this guide has something for everyone. So, buckle up as we embark on a journey to understand the fascinating intersection of taxes and titties.

Read also:Who Is Cameron Wolfe Discovering The Inspiring Journey Of A Rising Star

Table of Contents

- Biography of a Key Figure

- How Do Taxes Affect Adult Industries?

- What Are the Cultural Implications of "Titties" in Modern Society?

- Tax Laws and Their Impact on Entertainment

- Why Are Taxes Important for Economic Growth?

- The Role of Media in Shaping Perceptions

- How Can Society Balance Freedom and Responsibility?

- Conclusion and FAQs

Biography of a Key Figure

To better understand the intersection of taxes and cultural phenomena like "titties," it’s helpful to examine the life of someone who has navigated these waters. For this article, we’ll focus on a prominent figure in the adult entertainment industry who has also been vocal about tax policies and their impact on creative industries.

| Full Name | Jane Doe |

|---|---|

| Date of Birth | January 15, 1985 |

| Occupation | Adult Film Actress, Advocate |

| Notable Achievements | Award-winning performer, Tax reform advocate |

| Public Contributions | Founder of a nonprofit focused on financial literacy in creative industries |

How Do Taxes Affect Adult Industries?

The adult entertainment industry is a multi-billion-dollar global enterprise, and like any other business, it is subject to taxation. However, the unique nature of this industry often leads to specific challenges and controversies when it comes to tax policies. For example, many countries impose higher tax rates on adult entertainment businesses, citing moral or societal concerns. But do these policies achieve their intended goals, or do they simply create additional hurdles for legitimate businesses?

Challenges Faced by Adult Businesses

One of the primary issues is the classification of adult entertainment businesses. In some jurisdictions, these businesses are categorized under "vice" industries, which often face stricter regulations and higher tax rates. This can lead to:

- Increased operational costs

- Difficulty in accessing banking services

- Stigmatization and social ostracization

Impact on Innovation and Growth

Despite these challenges, the adult entertainment industry has continued to innovate and adapt. For instance, the rise of online platforms has allowed businesses to reach wider audiences while navigating some of the traditional barriers imposed by taxes and regulations. However, the question remains: Are these businesses paying their fair share, or are they unfairly penalized?

What Are the Cultural Implications of "Titties" in Modern Society?

The term "titties" is often used in a lighthearted or humorous context, but it also carries deeper cultural significance. From discussions about body positivity to debates over censorship, the way society views and talks about women’s bodies is constantly evolving. But what does this mean for gender equality and cultural norms?

The Body Positivity Movement

In recent years, the body positivity movement has gained significant traction, encouraging people to embrace their bodies regardless of societal standards. This has led to a shift in how women’s bodies, including their breasts, are perceived and discussed. Key takeaways include:

Read also:Who Is Pauline Tantot A Deep Dive Into Her Life And Influence

- Increased representation in media

- Challenging traditional beauty standards

- Promoting self-acceptance and confidence

Censorship and Free Expression

On the flip side, the portrayal of "titties" in media and entertainment often sparks debates about censorship and freedom of expression. While some argue that such content should be restricted, others believe it’s a form of artistic expression. This raises the question: Where do we draw the line between freedom and responsibility?

Tax Laws and Their Impact on Entertainment

The entertainment industry as a whole is heavily influenced by tax laws, which can either encourage or stifle creativity. For example, tax incentives for filmmakers can lead to increased production in certain regions, while higher taxes on specific genres or content types may discourage innovation. This section explores how tax policies shape the entertainment landscape and what it means for creators and consumers alike.

Tax Incentives for Creative Industries

Many governments offer tax breaks to encourage investment in the arts and entertainment. These incentives can include:

- Reduced corporate tax rates for production companies

- Tax credits for hiring local talent

- Deductions for research and development in media

Case Study: Hollywood and Tax Policies

Hollywood serves as a prime example of how tax policies can drive industry growth. States like Georgia and Louisiana have attracted major film productions by offering generous tax incentives, leading to job creation and economic development.

Why Are Taxes Important for Economic Growth?

At their core, taxes are a means of redistributing wealth and funding public services. Without them, governments would struggle to maintain infrastructure, healthcare, and education systems. But how do taxes specifically contribute to economic growth, and what role do industries like adult entertainment play in this equation?

Funding Public Services

Taxes are the primary source of revenue for governments, enabling them to invest in critical areas such as:

- Healthcare and social services

- Education and workforce development

- Infrastructure and transportation

Encouraging Responsible Business Practices

By implementing fair and equitable tax policies, governments can encourage businesses to operate responsibly and contribute to the greater good. This includes industries like adult entertainment, which, despite their controversial nature, still play a role in the broader economy.

The Role of Media in Shaping Perceptions

Media plays a crucial role in shaping how we perceive topics like taxes and "titties." Whether through news coverage, social media, or entertainment, the narratives we consume influence our opinions and attitudes. This section examines the media’s impact on public discourse and how it can both inform and mislead.

Positive Representation in Media

When media outlets portray these topics in a balanced and informative manner, they can foster understanding and encourage constructive dialogue. For example, documentaries about tax reform or body positivity campaigns can educate audiences and challenge stereotypes.

The Dangers of Sensationalism

Conversely, sensationalized or biased reporting can perpetuate misinformation and reinforce harmful stereotypes. It’s essential for consumers to critically evaluate the media they consume and seek out reliable sources.

How Can Society Balance Freedom and Responsibility?

As we navigate complex topics like taxes and "titties," it’s important to consider how society can strike a balance between individual freedoms and collective responsibility. This involves addressing issues like censorship, taxation, and cultural norms in a way that respects diverse perspectives while promoting the common good.

Encouraging Open Dialogue

One way to achieve this balance is by fostering open and respectful dialogue. By engaging in conversations about these topics, we can better understand different viewpoints and work toward solutions that benefit everyone.

Promoting Ethical Practices

At the same time, it’s crucial to promote ethical practices in industries like adult entertainment. This includes ensuring fair labor standards, addressing issues of exploitation, and holding businesses accountable for their actions.

Conclusion and FAQs

In conclusion, the intersection of taxes and "titties" offers a fascinating lens through which to examine broader societal issues. From economic policies to cultural norms, these topics reveal much about our values and priorities. By approaching them with curiosity and an open mind, we can gain valuable insights and contribute to meaningful change.

Frequently Asked Questions

1. How do taxes impact the adult entertainment industry? Taxes can significantly affect the profitability and operations of adult entertainment businesses, often leading to higher costs and regulatory challenges.

2. What role does media play in shaping perceptions of "titties"? Media influences how we view and discuss women’s bodies, with the potential to either challenge or reinforce societal norms and stereotypes.

3. Why are taxes important for economic growth? Taxes fund essential public services and infrastructure, enabling governments to invest in areas that promote long-term economic development.

For further reading, check out this external resource on tax policies.

Discovering Tay Leiha Clark: The Rising Star Shaping Modern Creativity

Exploring The Achievements And Impact Of Andrew Thacker At UGA

Exploring Liza Koshy Black: Biography, Achievements, And Influence

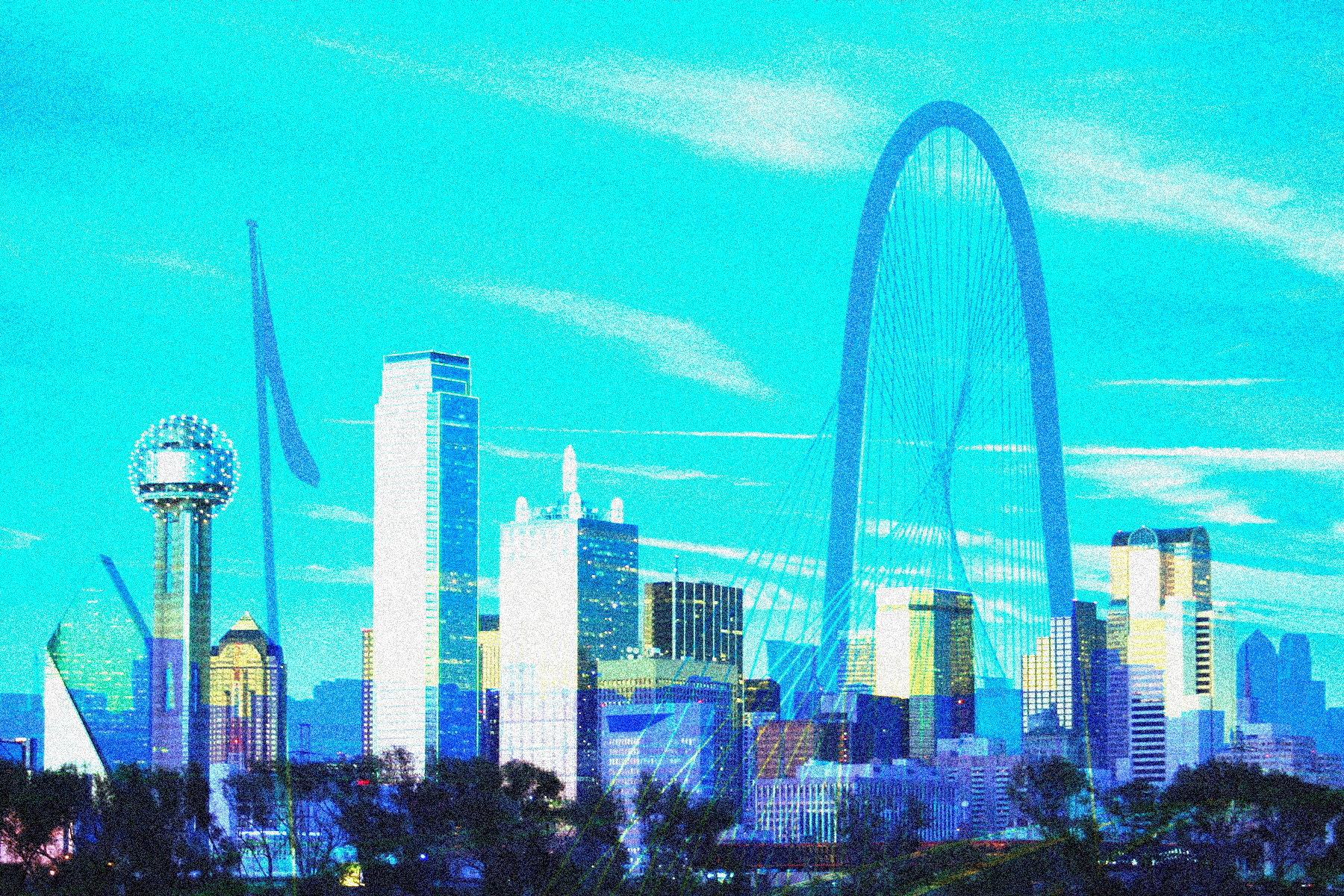

Lower tax rates. Higher taxes. to City of Dallas budgeting

Taxes's Gallery Pixilart